About Us

Welcome to Finsbury Reinsurance

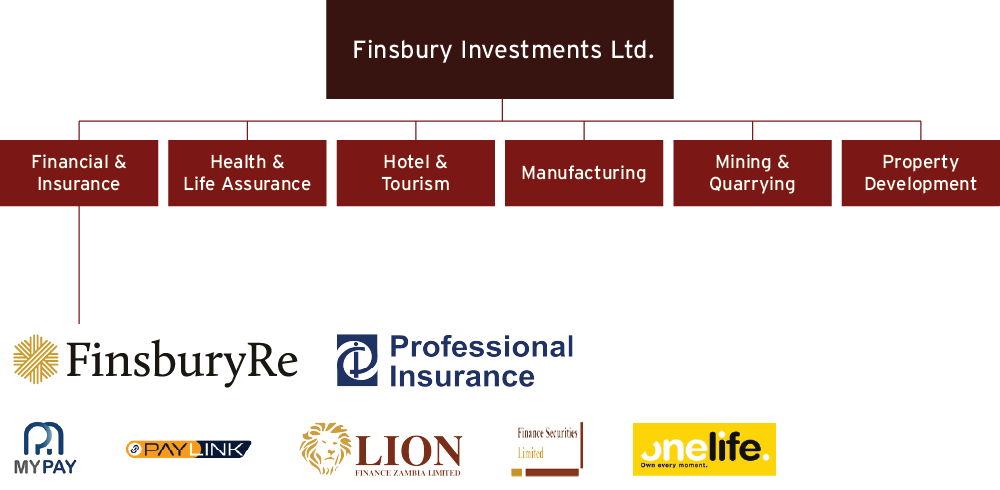

Finsbury Reinsurance Limited (Finsbury Re) was incorporated on 27 July 2023 in Zambia. We are licensed and regulated by the Pensions and Insurance Authority (PIA) to provide reinsurance services. Our headquarters is at our registered office of 2nd Floor, Finance House, Heroes Place, Cairo Road, Lusaka, Zambia. Finsbury Re is 100% owned by Finsbury Investments Limited, incorporated in 1981 and currently one of the largest private investment groups in Zambia. It is the holding company of the Mahtani Group of Companies, comprised of over 20 companies in sectors as diverse as Banking, Financial Services, Insurance, Information Technology, Hotel & Tourism, Mining & Quarrying, Manufacturing, and Property Development.

Our uniqueness is grounded in the strength of the group’s existence for over 30 years, present in over five countries, with a significant component of the group’s holdings in the Zambian market. As a subsidiary, Finsbury Re inherits a reputation for being a top local market player and a robust force in international reinsurance spaces. Inspired by the desire to exponentiate local industry growth, our ambition is to play an exemplary role of an outstanding security right from Zambia, spreading across Africa, Asia-Pacific, and Latin America, where Finsbury Re will offer dynamic service and be the partner of choice to our esteemed customers.

Our overall goal is to provide unmatched reinsurance services appreciated at the international level and benchmarked against global standards.

Our Vision

To be a model provider of reinsurer solutions.

Our Mission

Provide customer-centric reinsurance solutions sustainably, innovatively and professionally.

We are in a strong position to keep our promises through the most unexpected and catastrophic events.

ZMW 95 million

Our paid-up capital.

Shareholders are committed to steadily increase capitalisation.

Corporate Values

Our values guide the way we do things to ensure we fulfil our vision, mission, and objectives. The solid foundation of FinsburyRe’s culture is based on the following values.

Fairness

Our customers will be treated fairly while our employees, as our prized asset, will be equitably compensated, and our shareholders shall be paid a fair return on their investment.

Newness

As a customer centric organisation, we will always seek to find innovative ways of meeting our customers’ needs by employing technology.

Integrity

In all our dealings, we will act with honest, and our word shall be our bond.

Reliability

Whatever we shall commit to, we will deliver in the most efficient and effective manner.

Excellence.

FinsburyRe shall provide a service with distinction.

Our Strategy - The “A Game”

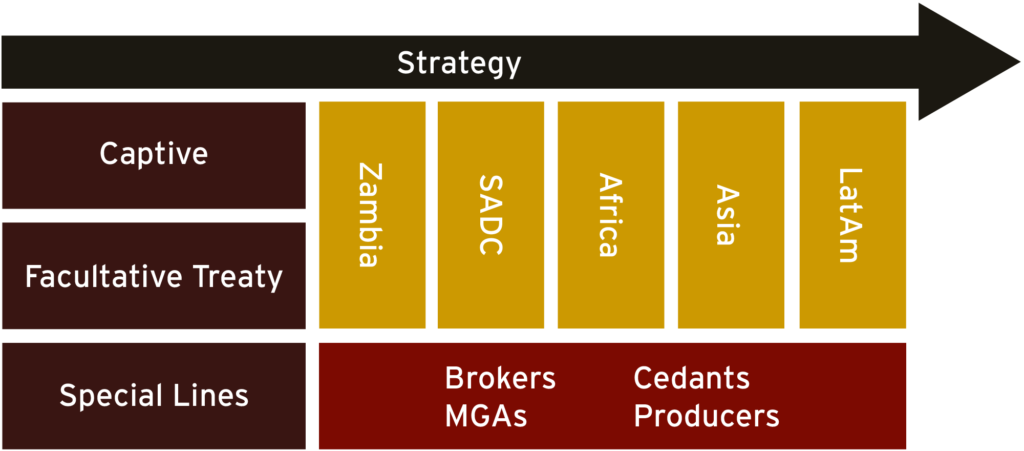

Coined the “A Game”, our strategy is formulated to gear Finsbury Re in achieving its 5-year corporate strategic goals innovatively and professionally. It is crafted around a triad concept comprising three principles: Aspire, Act, and Achieve.

Aspire reflects our commitment to helping businesses achieve their goals through customer-centric solutions. We are cognisant that all businesses have aims and goals. This first pillar of the triad seeks to demonstrate our focus on helping businesses realise their goals. Our aspirations are demonstrable through providing solid protection via de-risking.

Act reflects our drive that urges businesses to implement strategies effectively. Until aspirations are followed by a call to action, there is no success. This pillar gears Finsbury Re for growth by taking appropriate action to realise our vision. This will be anchored on building solid partnerships with brokers, MGAs, cedants, and other key stakeholders. An incremental growth strategy as opposed to drastic one, has been adopted to ensure the business continuously builds capacity internally with on-going mastery of the risk acceptances for retention and growth.

Achieving at Finsbury Re means everything. The overarching notion for success to us and our divergent stakeholders is premised on the triple bottom line sustainability framework based on 3 key areas; people, profit, and planet and aligning to the ESGs. Employees are our prized assets and success to them means fair compensation for their contribution to the company comparable to international standards. We invest significantly in quality staff, skills development and strive to be an employer of choice. It is our aim that sshareholders earn a fair return on their investment from profits generated by a business run on the highest of corporate governance standards, while also ensuring that all activities promote a green planet that reduces carbon emissions and promotes sustainability globally.

Finsbury Re Company Profile

Our Claims Service Philosophy

Fin Re values its commitment to high standard claims service, with adherence to best claims handling & management practices and ensuring that we are in the top class of excellence. We bring our ‘A’ game to this critical area of our service, aligned to achieving our vision of becoming a model source of reliable reinsurance solutions through claims settlement.

We are resolute to give you a warm and lasting customer experience, the “Fin Re Way” by always being timely, remaining fair, reasonable, maintaining high level of integrity and being reliable and “treating customers fairly” at the heart of our philosophy. Our promise is to settle all valid claims with prompt feedback to ensure efficient and effective service delivery, strongly underpinned by our customer-centrism.

We pride in having the best qualified staff that manages our fully functioning internal claims department, having the relevant experience and associated tools to assess all future claims. Our team will ensure that they are handle both professionally and efficiently.

Fin Re aims to make a difference through the service we offer to you, our esteemed customers. We value your reputation, so you can entrust us to serve you ALL THE WAY!

Tips for efficient claims settlement: –

- Premium payment warranty adherence

- Claims notification clause adherence

- Submission of policy documents

- Submission of loss adjusters report(s)

- Submission of relevant claims substantiating documents related to the loss

- Clear communication

For any claims complaint, kindly click below: